Introduction

With life comes debt. Unless you have large savings, a new (or used) car, a house, a holiday, an unexpected boiler breakdown will likely result in a finance application. And the list goes on; before you know it, you have 10 creditors all requiring a portion of your monthly income.

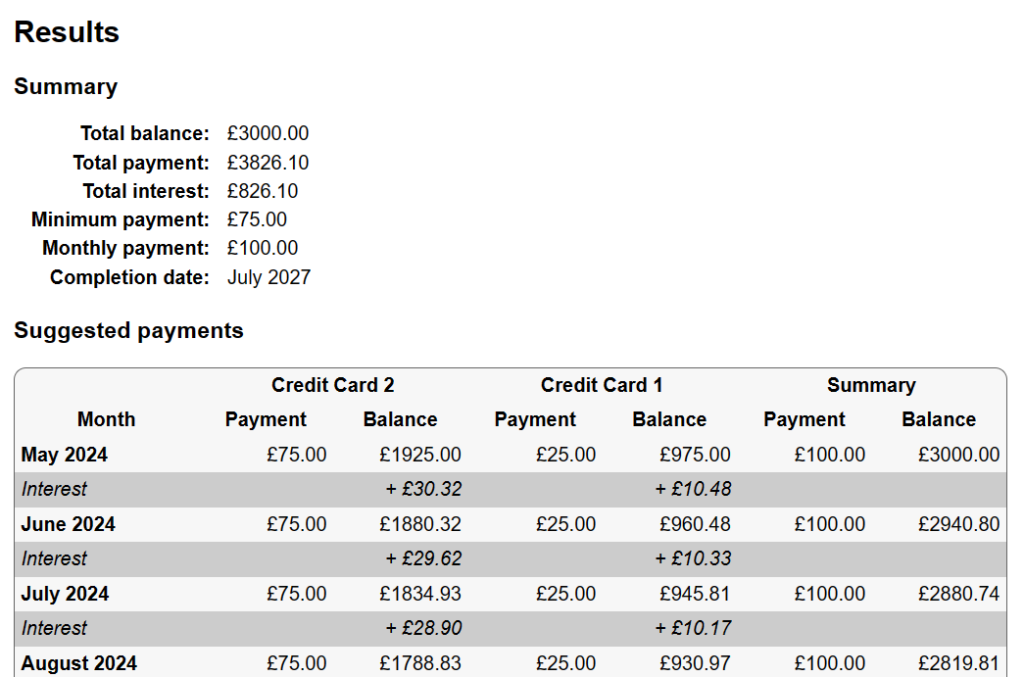

Generally it is considered best to pay the highest interest rate debts first. If multiple debts have the same APR; clearing the lower of the debts will give the quickest “feel good” moment and free up another minimum payment to be spread across other debts.

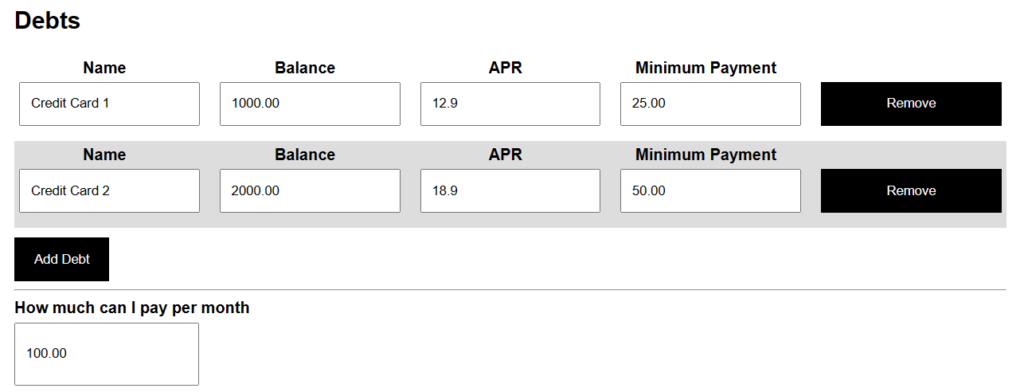

Try the debt repayment calculator

The debt repayment calculator is hosted outside of the main site as a micro-application to ensure it’s separation from general user tracking. You can either run the debt calculator from our servers with minimal anonymized usage tracking, or download the JavaScript web application to run on your local machine and inspect the code if desired.

Found an error

If you believe you have found an error in the calculations, or have suggestions to improve the calculations, please contact me, create a pull request on the GitHub project, or leave a comment below.

Disclaimer

I am not a professional in the field of debt management, far from it; this micro-application is based on my life experience in managing personal debts. This is a tool which I created many years ago to manage my own debt repayments and have recently revised to make public.

If you are struggling with debt, please seek professional help, Gov.uk has a guide on options for dealing with debt (UK).

Should you have debts that are affecting your health, please seek help – NHS Mental Health Services (UK).

Usage tracking

The debt repayment calculator is a pure HTML and JavaScript application with no backend, this micro-application does not store any of your personal data on our servers. Minimal anonymous usage tracking, including demographic (country location, web browser version, operating system) is logged and used to monitor visitor numbers as well as ensuring the application is compatible with the environments it is used in.

Data that is not tracked: Any personally identifiable data, data on debts being used for calculations, data on suggested repayment plans.

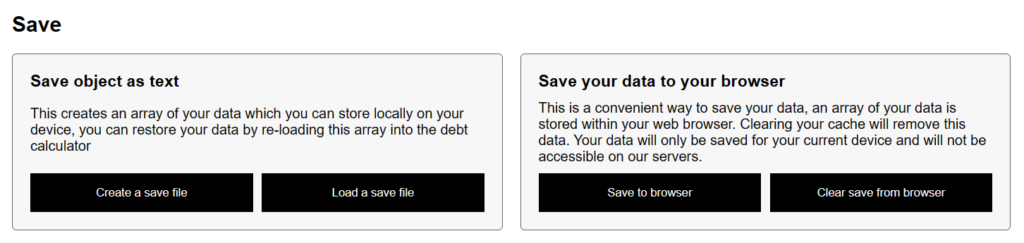

As we do not store any personal data with this micro-application, you may wonder how you can save your data for later retrieval. One of two methods can be used:

- Local browser storage – with this method, your web browser stores a small data-set that can be used to re-load a prior save. Data is stored on your local machine and as such your save will only be accessible from the same computer and even then, only using the same web browser.

- Save files – with this method, a text string is displayed for you to save on your local computer, to re-load this save data, simply paste the text string into the relevant box on the debt calculator.

GitHub

Last commit: April 22, 2024 - 06:58pm

Forks: 0

Open issues: 0

Stars: 0

Watchers: 0

No comments on Paying debts faster with code